From your dashboard, scroll down to "Income & expenses". Filter for the date range you need by clicking on the date range and selecting “Custom Range”. Select your date range and click apply.

Next, on the graph, click on the DARK red bar to show a list of all the “Expenses” transactions. This report will include all your musician payouts as well as any manual expenses you added inside your bookings.

From the popup that opens, click on "Export rows to CSV"

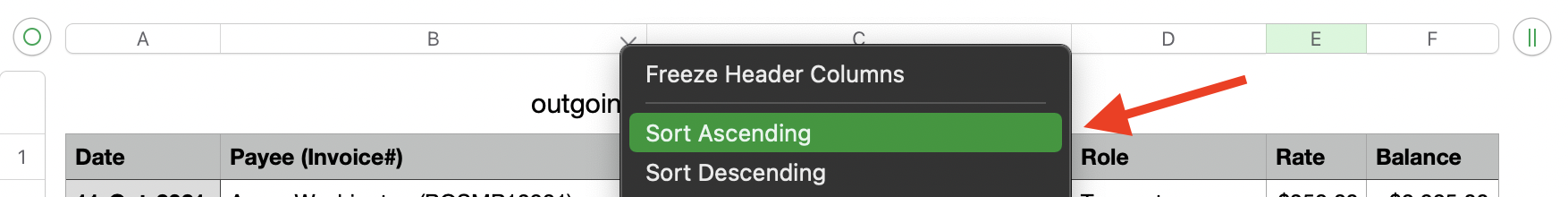

Open the exported spreadsheet in your favorite spreadsheet software (we recommend Google Sheets). Then you can sort by the “Payee” column to group all your payouts by musician, enabling you to easily calculate totals paid to each musician.